The Best Choice & All-in-one solution for Open Banking Today!

About Chirp

More than 50,000 financial connections in the US & Canada.

With the ability to connect to payment apps, saving apps, budgeting apps, credit unions, traditional banks, neo-banks and branchless financial institutions.

Chirp will allow consumers to share transactions via Chirp with a continuous 24/7 financial institution connection.

Data is securely transferred and maintained. Chirp does not sell, rent or share any personal data from any customers or their connected accounts.

Why Choose Chirp

Fast. Responsive. Secure

Built with You in Mind

Budget Friendly

Better Data, Better Analytics

-

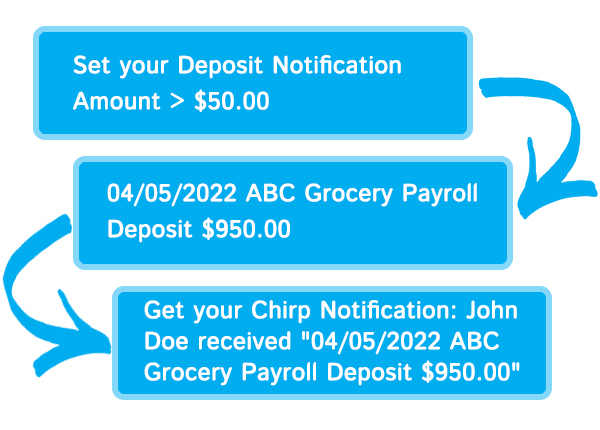

Deposit Notifications

Deposit Notifications can be completely customized with Chirp. Set deposit notifications in incremental dollar amounts, or min’s and max’s, to ensure you only receive notifications that are important to your business.

-

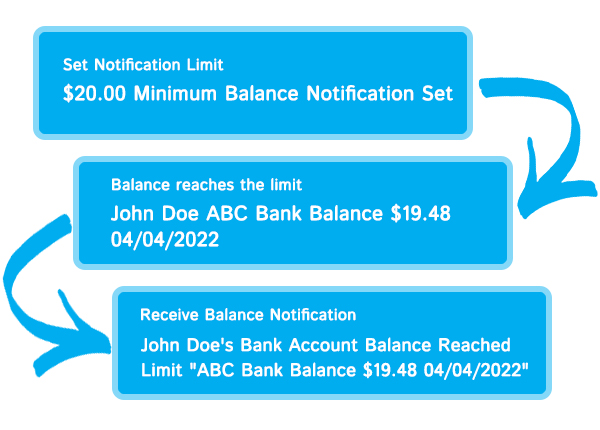

Balance Alert

Set your own balance alert. With Chirp balance alert you will be notified when a connected consumer account hits the balance you selected. Balance alerts are completely customizable and can be changed on the fly!

-

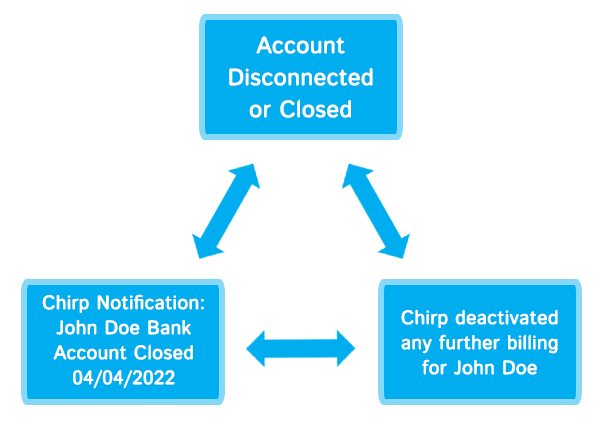

Account Status

Get notified when a connected account is disconnected or closed. We will notify you when a connected account is removed. Chirp will proactively remove this account from your platform. This will ensure that you are no longer paying for an active connection on a disconnected account.

How Chirp Works

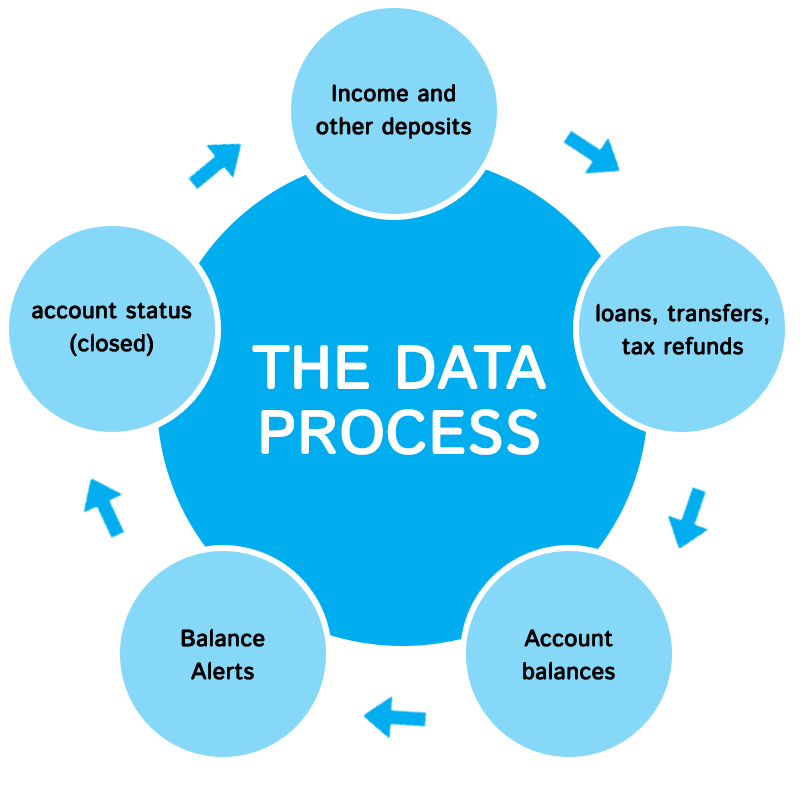

Chirp will keep you in the loop with customized account notifications related to

deposits, balances, income, account status and much more…

Deposit Notification

Connected accounts will be able to share any type of deposit from income, loans, payment app transfers, intra-bank transfers, un-connected bank transfers, tax refunds and many other deposit types.

Balance Alert

Additionally, Chirp can monitor the available balance on connected accounts.

Account Status

The status of a connected account will be examined with the ability to receive connected account status (closed).